If you are looking to start hosting on Airbnb or looking to optimize pricing of your current listing, then you’ll want to use an Airbnb analytics tool like AirDNA to see what your competition is doing.

Why use AirDNA?

Airbnb has a pricing tool built into their system… so why should you spend money on a pricing tool if Airbnb has one already?

Simple…

Airbnb optimizes for higher occupancy, not for profitability… good for them, not good for you…

Instead, you’ll want to…

#1 Optimize your short term rental for higher nightly rate not occupancy

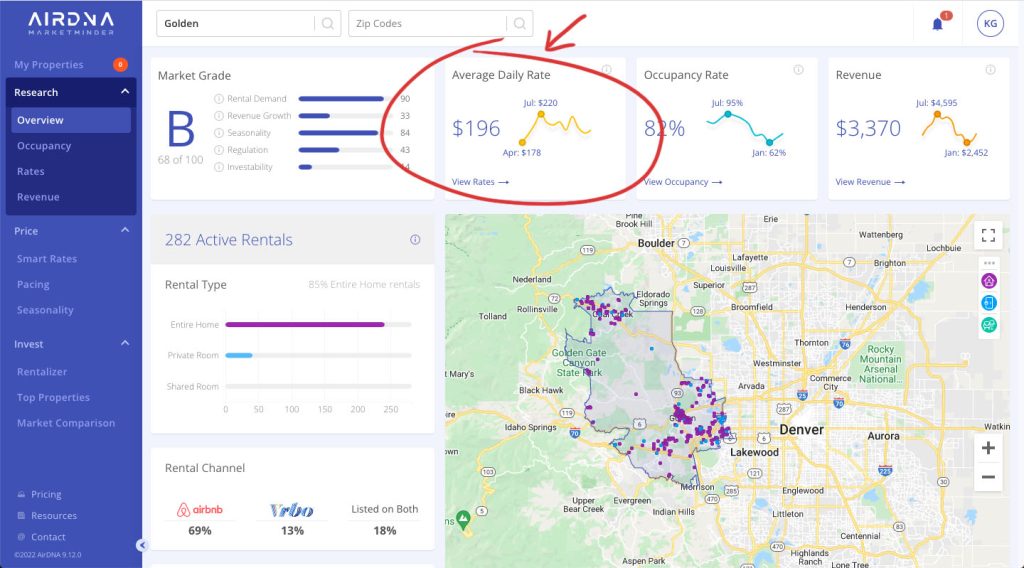

To run a successful Airbnb you’ll want to know the average daily rate of your competitors and see how your vacation rental stacks up against it.

You’ll want to get data on average daily rate, occupancy rate, revenue, and even market grade if you are looking to launch a new Airbnb in the area.

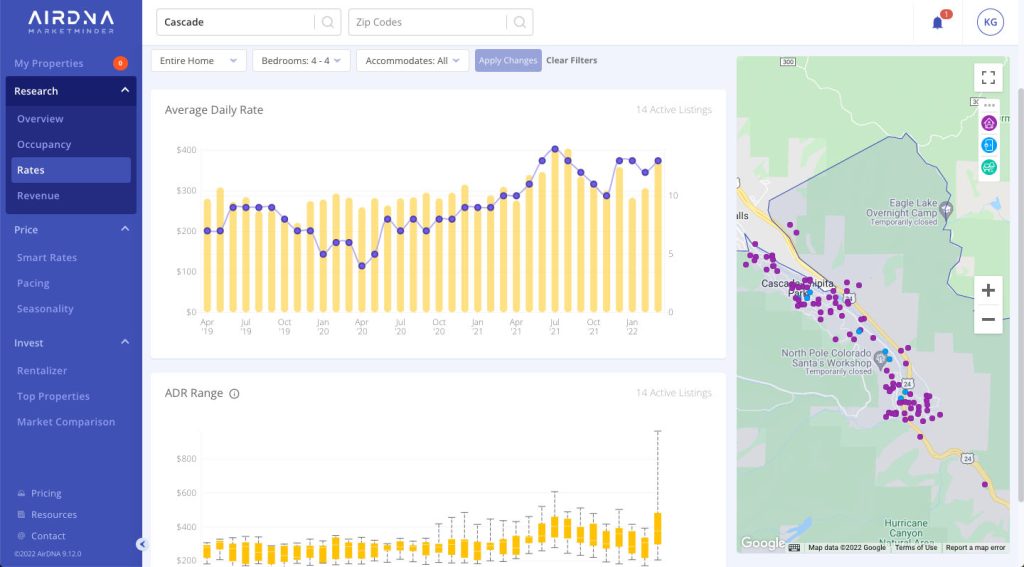

This is what the AirDNA Market Minder dashboard looks like…

Airbnb’s pricing tool is optimized to get you more bookings, but more bookings doesn’t make your short term rental profitable… as one of my mentors said, “if you want to be 100% booked, just price your Airbnb at $1/night”…

Obviously he was being facetious, but the point he was making was that pricing your short term rental low just to get more bookings is not how you increase the profitability of your short term rental…

Let’s say you are booked 100% by pricing your STR at $100 a night just for easy math…

$100/night X 30 days = $3,000

What if you could price at $150 a night and be booked only 2/3 of the month…

$150/night X 30 days = $3,000

You can make as much with less guests going through your property, which means you can save on turnover expenses (cleaner fees, laundry, etc.), and put less wear and tear on your property…

AirDNA is a tool you can use to find that sweet spot where you can earn more even if you are not booked 100%…

This is what optimizing for ADR (average daily rate) VS occupancy looks like…

That’s one reason why you’ll want to use a tool like AirDNA…

… but pricing your Airbnb isn’t a one time deal…

#2 Ongoing booking revenue management

Pricing your Airbnb should be done the same way as hotel and airlines do their pricing… hotels call this “revenue management”…

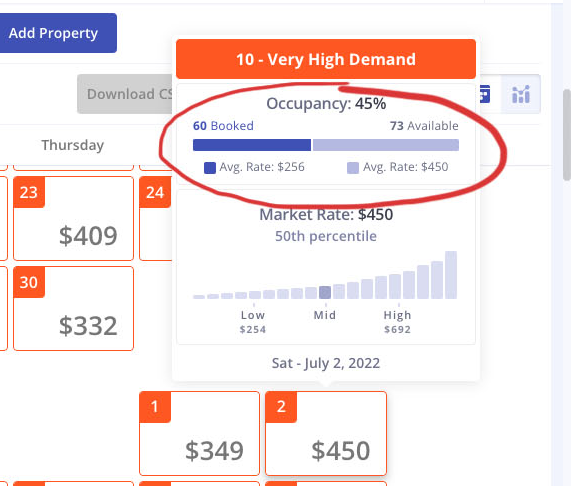

Vacation rental markets have seasons and events (concerts, seminars, etc.) when demand peaks and you can charge more during these nights if you are aware of these events… this is where a lot of hosts leave money on the table…

In this example you can see that the average Airbnb got bookings at an average nightly rate of only $256/night, yet the high demand is allowing other Airbnb hosts to book their property for almost double at $450/night…

One reason why our airbnb properties earn more booking revenue is because our airbnb property management team has a full time revenue manager dedicated just to adjusting pricing on all of our short term rentals on a daily basis.

Constantly adjusting your pricing based on market demand is called dynamic pricing, and every top performing Airbnb is definitely taking advantage of this. This feature alone will make a pricing tool like AirDNA worth it.

How do you use AirDNA?

There are many ways to use AirDNA. Pricing your current property is just one way, but this tool is also very popular for investors looking to buy a short term rental.

AirDNA can be used to find the best location, the best type of property, and give you numbers so that you can estimate if your short term rental will be profitable.

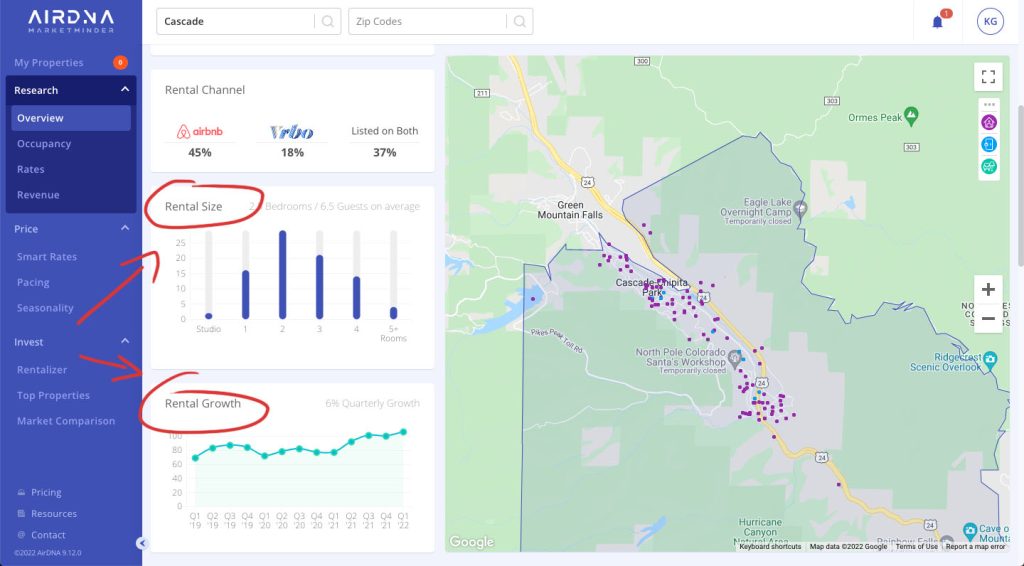

First you’ll want to find a city you are interested in and find a location that has good rental growth…

Once you find an area that interests you, you can start looking to see what other Airbnb’s are doing…

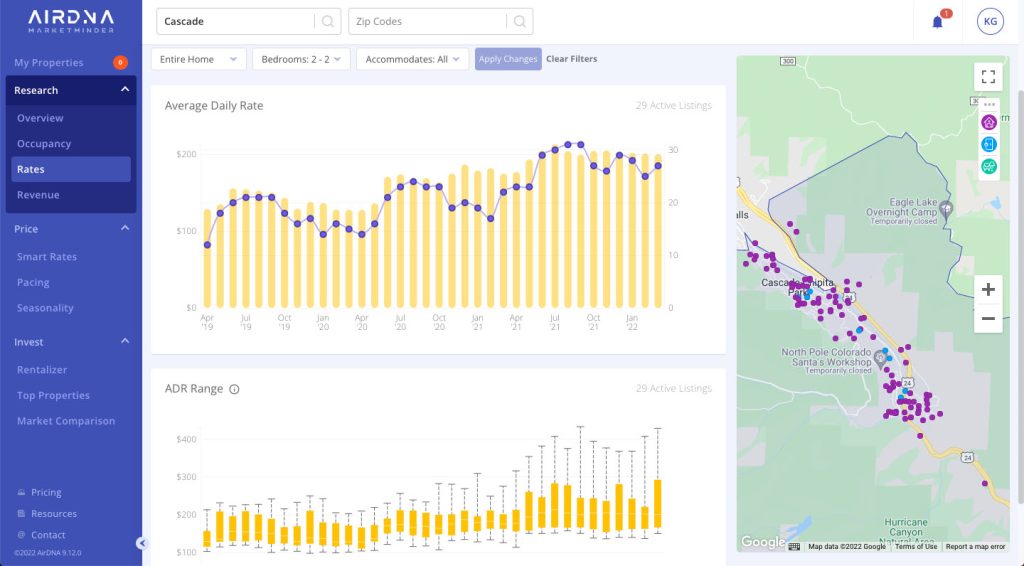

You can see for example that the average Airbnb in this area is a 2-4 bedroom… you can then get more granular information to see if buying a 2 bedroom home would be worth it, or if you should get a 4 bedroom home in this area.

We can see in this example that a 2 bedroom home has an average daily rate from $100-$200…

A 4 bedroom home in this same area has an average daily rate that ranges from $200 – $400…

This is one way you can find the best property to buy in the area… there is a lot more information you get that you should definitely use in making your decision like:

- Average Daily Rate

- Average Number of Bedrooms

- Average Number of Guests

- Historical Occupancy Rate

- Average Monthly Revenue

- Booking Lead Time

- Typical Amenities and Property Ratings

Is AirDNA accurate?

While the numbers shown look good, we will say that there’s definitely noise in the numbers… We manage over 160+ properties so we definitely need accurate information to make our pricing decisions.

AirDNA claims to be the most reliable data source with 96.2% accuracy.

Overall we’d say the data is pretty good, but there is noise in the numbers which we’ll cover in the pros and cons below. We’ll be doing a full comparison review with AirDNA VS Pricelabs and other pricing tools we’re currently using and testing ourselves to get accurate pricing data.

Pros and Cons of AirDNA

Here’s what we like about AirDNA

One of the things we like the most about AirDNA is that it’s easy to use and intuitive. You can connect your properties and it will automatically push price updates to different booking platforms. With 96.2% accuracy, it definitely helps automate revenue management which is a good time saver when you build up a short term rental portfolio of 5 or more properties…

Here’s what we don’t like about AirDNA

Pricing is good if you are just looking at a specific location, but if you operate in multiple markets, then price can become steep pretty quick. Expensive is relative, if the tool makes you more money than you would if you didn’t use it, then it’s still worth, but we wish they had better packages for those operating in multiple markets.

There is no mobile app to use the tool, so you are limited to using this on a desktop or laptop… it would be nice to get quick access to some features on your phone when you’re out and about looking at properties.

Last… we mentioned there is noise in the numbers and one of those numbers is total revenue which includes cleaning fees and that can skew the numbers. If you have a good grasp on average cleaning fees in the area, you can adjust to get a more accurate picture, but new investors may not have this information so beware.

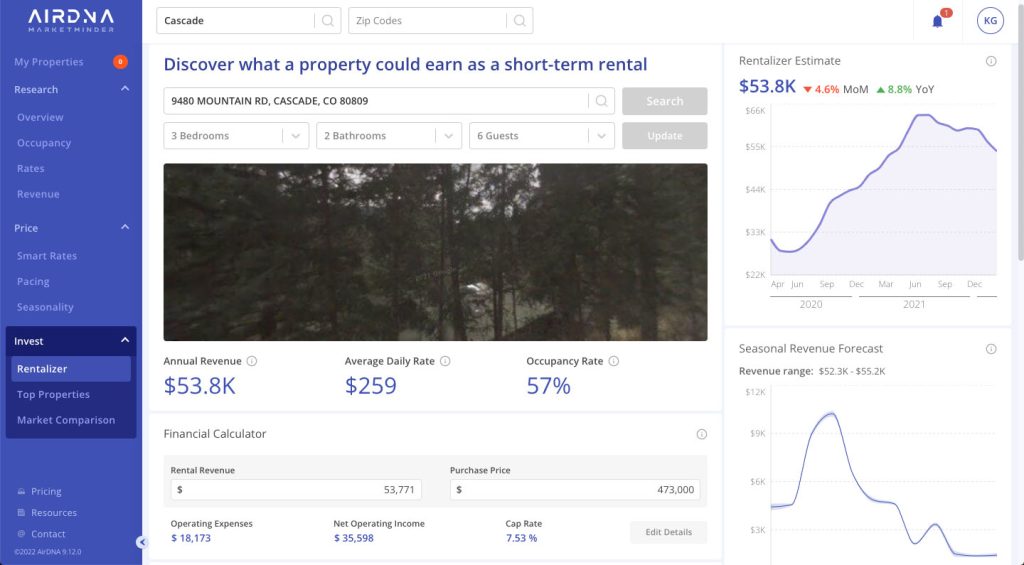

AirDNA Rentalizer Tool

If you are looking to buy (or sell) a property, you can use the AirDNA Rentalizer tool to get an idea of how the property stacks up against the competition…

This is a new way to determine the value of a home. I spent years as a market analyst and acquisition specialist buying homes for iBuyers like Opendoor, Offerpad and other investors. When looking at homes using the traditional comparative market analysis by looking at sold comps, we wouldn’t be able to offer enough to buy homes. However, when you take into account the revenue potential of a home, that’s what we saw started driving home prices as investors started coming in to scoop up property that would cashflow as a vacation rental.

You can get fairly accurate estimates on performance data just by entering an address in the Rentalizer tool and you will get data on things like

- Annual revenue

- ADR (Average Daily Rate)

- Occupancy Rate

- Seasonal Revenue Forecast

The Rentalizer tool also has a financial calculator that allows you to enter and adjust the purchase price of the home (as well as rental revenue) and give you an estimate on:

- Operating expenses

- Net Operating Income

- Cap Rate

This is definitely impacting real estate prices so it’s a good tool that both home buyers and sellers should be considering.

It’s important to look at seasonal revenue because if you are buying during slow season, you may need to account for the reduced revenue and make sure you can hold the property until busy season.

The rentalizer tool will also show similar properties in the area so you can see how they are performing, what they look like and what kind of amenities they offer to make sure that your property can compete and see if there is opportunity to outperform current properties on the market.

Overall, we do recommend AirDNA as we use it ourselves to manage over 160 properties…

If you are looking to start an airbnb business, this tool can help you find your first property…

If you are looking to grow and scale your current airbnb business, this tool will help your airbnb listings perform better so you can earn more booking revenue and buy more properties.